Silly Money

How to Use Trump Accounts to Make Your Kids Tax-Free Millionaires

The new One, Big Beautiful Bill created a new type of retirement account for kids under 18.

These "Trump accounts" or "Invest America accounts" as they were previously called have been in the news for giving a free $1,000 to every child born in America between 2025 and 2028.

However, the free money from the government is potentially the least interesting thing about how these accounts work.

If you are a high earner that wants to set your children up for financial independence, you could arbitrage these accounts to make them tax-free millionaires by the time they retire.

Here's exactly how this could work:

Overview of Trump Accounts

The most important thing to understand is these accounts are a special type of RETIREMENT account for the benefit of your children.

While kids born between 2025 and 2028 will get a free $1,000 from the government, all children under the age of 18 are eligible to start one.

This means over 70 million Americans are eligible for these accounts!

However, since these are retirement accounts, there are a whole host of restrictions when it comes to being able to actually get money out of these accounts:

1. Your kids cannot get any money out until the age of 18 — for any reason.

2. After the age of 18 and before retirement age (59.5), they can only take money out penalty-free for a few handpicked reasons like qualified educational expenses and up to $10K for a down payment on their first house.

Otherwise, any dollars withdrawn before the age of 59.5 will also be subject to a 10% penalty on top of taxes.

3. They have to pay ordinary income taxes on the money when it is withdrawn.

With all these restrictions in place, when does contributing to a Trump account even make sense?

Contributing to a Trump Account

The most valuable feature of a Trump account is you can jumpstart a retirement account for your children without them needing earned income.

Prior to this account existing, if you wanted to open a custodial Roth IRA for your child, they would have to have earned income from a job to contribute.

No such requirement exists with Trump accounts!

This means you can contribute to these accounts much earlier, and for a longer time prior to them becoming adults.

You have multiple options for contributing to these accounts:

Parents can contribute up to $5,000 a year after-tax to these accounts per child every single year for the first 18 years.

Employers of the parents can contribute up to $2,500 a year per child pre-tax to these accounts as an employment perk.

The upshot is you can generally load in at least $90,000 (will be more in reality as the $5,000 is pegged to inflation) in original contributions over 18 years.

Parents that are business owners also have a unique opportunity to set this up as a business perk for themselves.

Each parent can have their business make these contributions, and potentially make the entire $5,000 contribution tax-free if they want, with $2,500 coming from each side.

Converting to a Roth IRA at Age 18

Here's the magic that pulls this entire strategy together: at the age of 18, your kid can choose to convert the entire account to a Roth IRA.

While this conversion is partially taxable, it unlocks a few incredible benefits:

1. The entire converted amount (which would be 6-figures) is accessible to your kid at any time for any reason 5+ years after the conversion.

They no longer need to wait until retirement to have access to the dollars!

2. There are no further taxes due on the money. This sets them up for a massive tax-free retirement nest egg.

Assuming they never contribute to a Roth IRA after the age of 18, and the money is simply invested in the S&P 500, it compounds to an incredible $12M by the time they turn retirement age!

How "expensive" is this taxable conversion at the age of 18?

While you do not have to pay any taxes on the after-tax contribution basis (which could be $90,000+), you still have to pay ordinary income taxes on any earnings and any pre-tax contributions.

While this can feel expensive, it's worth noting that this is taxed as income to your kid... so if they don't have any other income, it can likely be done at a very low tax bracket!

You could also stagger it out over 4-5 years while they don't have much income to keep almost all of it at very low tax bracket.

Putting it All Together

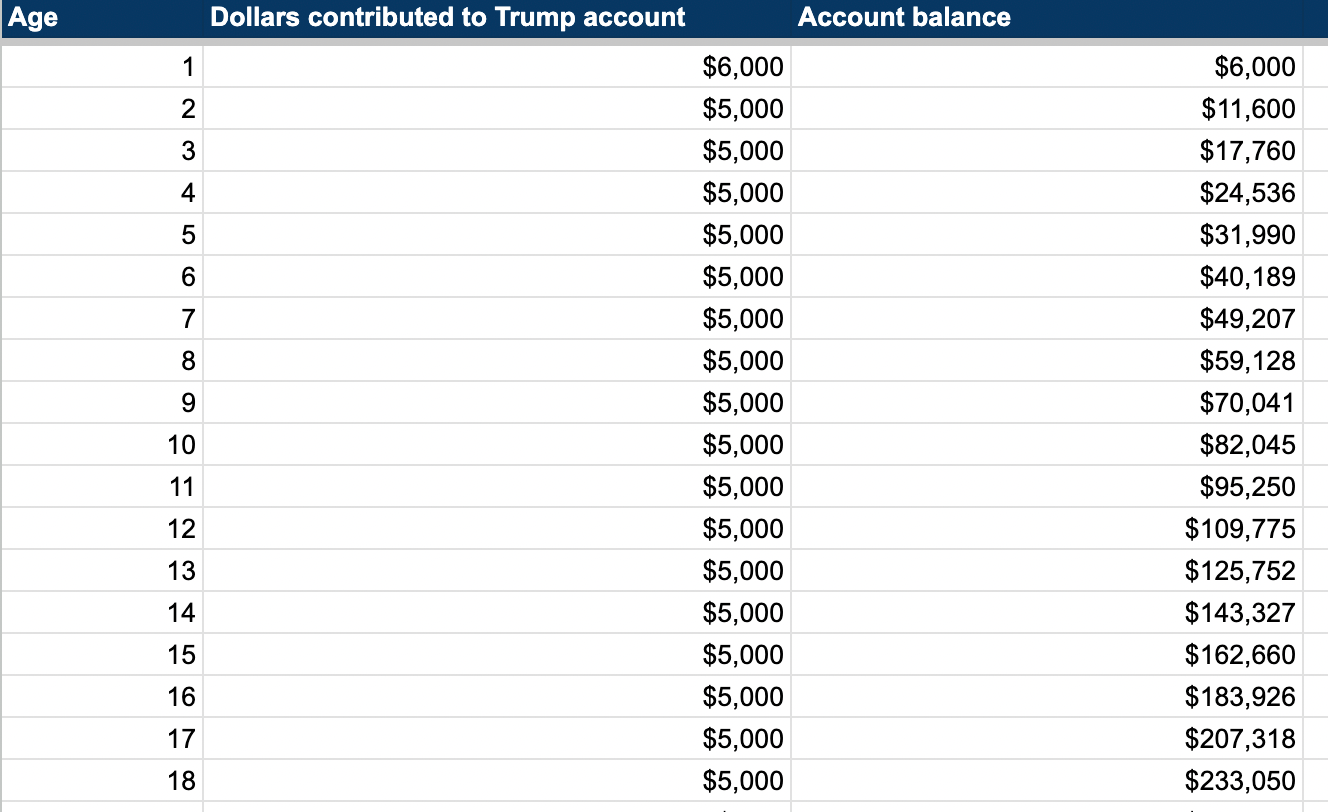

To illustrate just how powerful this can be, I built a very simple model.

These were my assumptions:

1. We maximize the $5,000 contribution every year for the first 18 years.

2. The money is invested in the S&P 500 with dividends automatically reinvested. Over the last 100 years, this has returned a bit over 10%.

For simplicity, I kept it at a flat 10% in the model.

Compounding this forward, this results in ~$233,000 at the age of 18 and at the time at which we can start converting to a Roth IRA.

Assuming no further dollars are ever contributed by your kid, it still leads to a tax-free retirement nest egg of over $12M by the time they hit retirement age!

I'll admit at first I overlooked just how powerful these accounts are — I was focusing on the wrong thing, which was the free $1,000 from the government.

Instead, the two most powerful features are:

Parents can contribute any income (and not just earned income by the child)

Being able to convert these to a Roth IRA at the age of 18.

These accounts will start to become available from 2026 onwards.

We're trying to see if we can offer a powerful version of this account type with built-in conversions… if you are interested in that, you can sign up for the waitlist here.

Otherwise, see you next week.