Silly Money

Why I Stopped Investing in Index Funds

Index funds are incredible.

Warren Buffet famously won a bet that a low-cost index fund that tracked the S&P 500 would beat any index of expensive, actively managed funds.

And the data backs this up.

For the last 100 years, investing in the S&P 500 and automatically reinvesting all dividends has returned over 10% annually.

That is a staggering performance over an incredibly long period of time.

As a result, the average investor no longer has to worry too much about what to invest in.

They can simply set up a recurring deposit into an index fund and allow their money to grow with the stock market.

However, just as index funds were revolutionary back in the day... I believe the future of investing for the next decade will be direct indexing instead.

Let’s dive into exactly what that is and how I am personally employing this strategy to manage my money.

Full Disclosure: I'm writing this as myself, not as some investment adviser or broker-dealer. Purely educational or my personal thoughts - not investment, legal, tax, or professional advice. While my startup Carry owns an investment adviser and broker dealer, this is not meant to be an advertisement and nothing here represents them. Financial decisions involve risk, including losing money. Taxes are complex. Please do your own research or talk to a licensed pro before acting on anything you read here.

Direct Indexing Overview

Direct indexing is a strategy that aims to replicate the performance of an index fund, while being more efficient with taxes.

Instead of buying a single fund that tracks the entire index, a direct indexing strategy will individually buy every single company in the index.

This approach will aim to track the performance of an index fund almost identically.

However, since you own every single name in the index directly, you have more opportunities to generate tax losses that can be sold off or "harvested".

These tax losses can offset future capital gains leading to more money in your pocket.

So the goal of a direct indexing strategy is: identical performance as an index fund, while saving you money on taxes.

Consider an example:

If you bought an S&P 500 index fund on January 1 2025, the index fund would roughly have a 7% gain at the moment (as of July 17 2025). This means you would get no usable tax losses that you can offset other gains from.

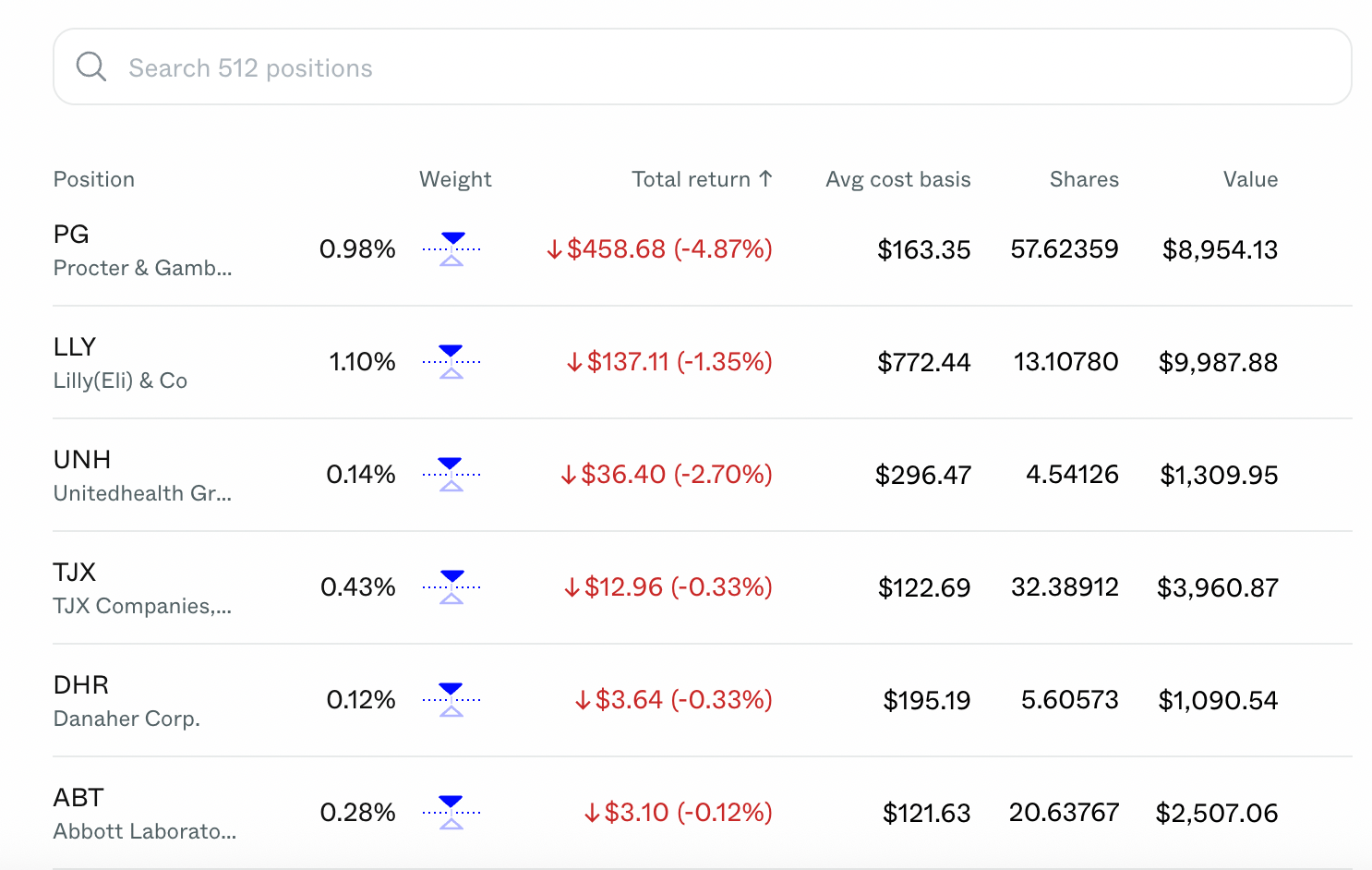

However, if you instead direct indexed into the S&P 500, you'd find that 100+ of the 500 companies are actually down for the year.

A good direct indexing algorithm would have kept selling losing positions to book a tax loss, while automatically re-buying certain names after a period of time to track performance with the index.

Companies are still down despite the market being up!

Same performance... but greater tax efficiency!

These losses can be then used to offset other capital gains you may have across other parts of your portfolio.

Setting up Direct Indexing

Implementing direct indexing by hand is virtually impossible.

However, there are a multitude of different direct indexing providers to look into that can automatically do this for you.

Personally, here's what I looked for while evaluating a provider:

1. Price

I've previously written about my experience working with private banks.

While they all provide direct indexing, it's usually at a really high price of somewhere between 0.5%-1.5% annually.

At those rates, I tend to think the benefits are likely not worth it.

So when I was looking for a provider, I was looking for something competitive with a Vanguard index fund that charges 0.05-0.10%.

2. Quality of the direct indexing algorithm

This strategy is only effective so long as it actually tracks the index accurately.

Theoretically, if you employed a direct indexing algorithm that generated tax losses, but did not accurately track the index by potentially waiting too long to buy something, you could end up missing out on meaningful performance.

Finding a reputable provider with good algorithms was very important to me.

3. Easy on and off-ramps

I'll share more later on the challenges and downsides of direct indexing -- but when evaluating a provider, you want to ensure that it's about as easy to both get money into and out of the strategy.

Ideally, if you can make in-kind transfers, direct indexing can be set up a lot more efficiently.

Pros and Cons of Direct Indexing

Is the juice worth the squeeze with direct indexing?

It depends on a few factors, specifically:

1. How much you are investing - this strategy tends to make sense at 6 figures or more indexing the market.

It is estimated that on average direct indexing can generate up to 40% of your initial investment as a usable tax loss.

So $1M in direct indexing could generate a ~$400,000 tax loss.

2. How frequently you are investing - this strategy is optimal if you are making new recurring investments on a periodic basis.

3. If you are open to adding another provider - most legacy providers do not have great direct indexing products, so you may need a new custodian.

Generally, the stated downsides of direct indexing are:

1. Complexity - if you don't have a good software solution to do this for you, it could complicate your setup and your taxes.

2. Price - historically, direct indexing solutions were very expensive but that's changing with newer providers.

3. You run out of tax losses - if you don't keep adding new dollars, after some time most companies will go up in your portfolio and you will run out of usable tax losses after a few years. You could end up paying for nothing then!

For me, these tradeoffs were more than worth it.

I am indexing a large amount of dollars into the stock market. And, I found a software platform that makes it very simple and does so for an affordable price.

My Direct Indexing Setup

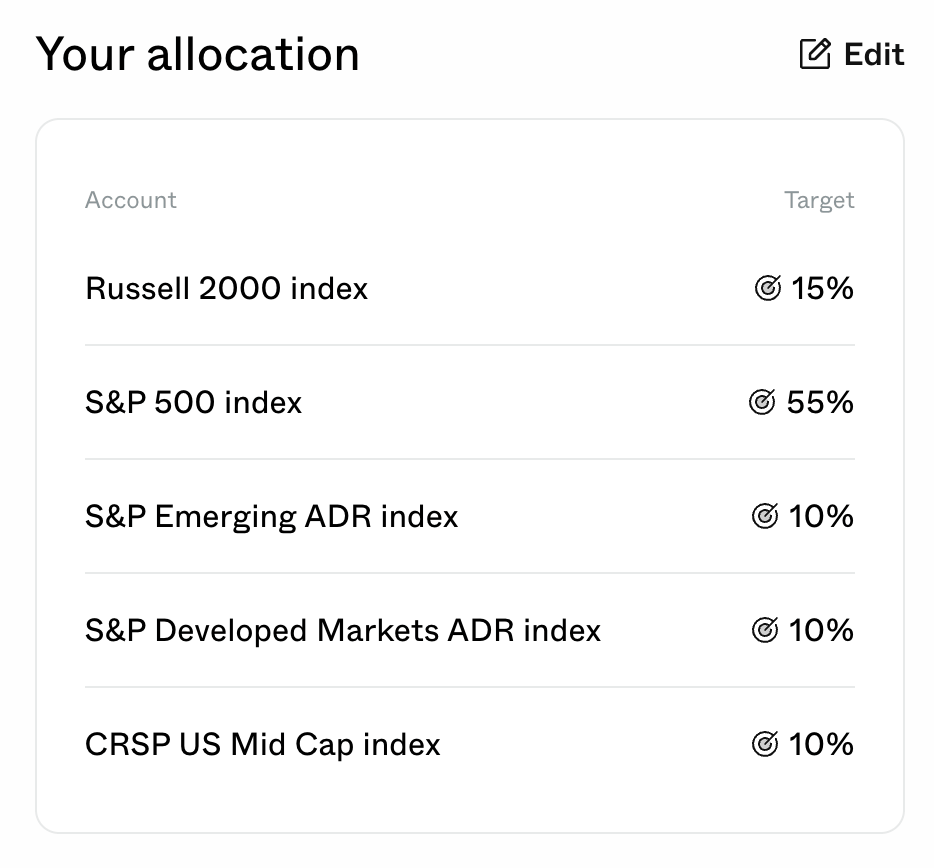

I now invest the majority of my dollars by direct indexing into a few different indices.

I created my own “allocation” based on exactly which indices I would like to track, and in roughly what percentages.

This is my current setup:

I have a recurring weekly deposit automated into this allocation and the software does the rest of the work for me!

It's performed phenomenally well for me so far.

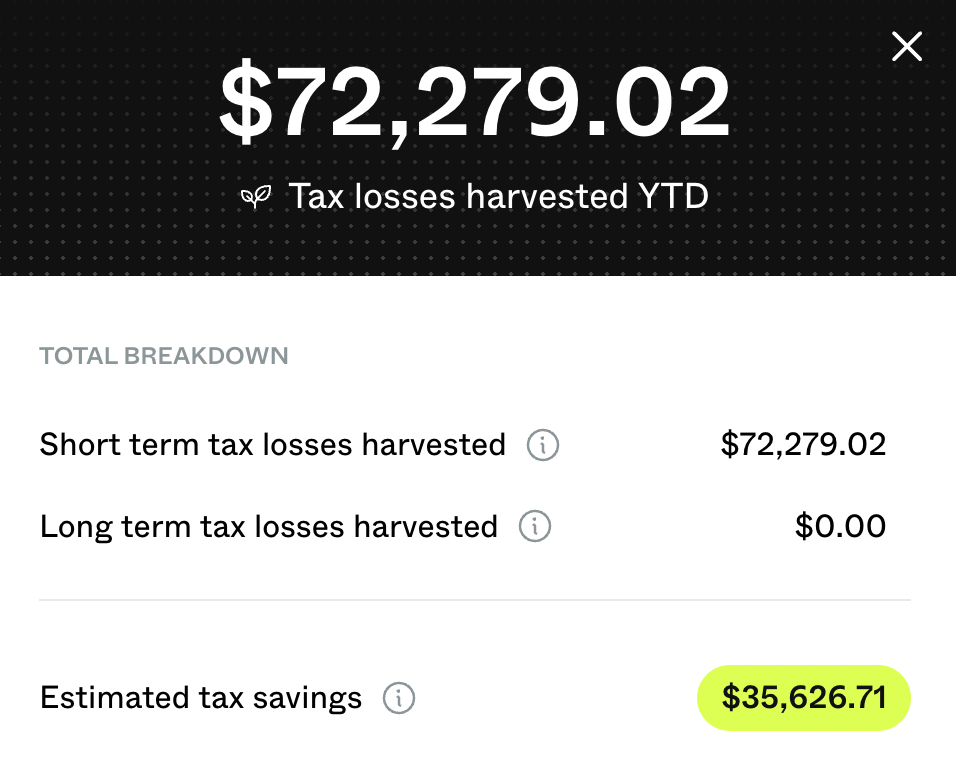

While every single index I've invested in is massively in the green… yet I've already generated almost six figures in usable tax losses:

The software solution I ended up choosing was Frec, for a few different reasons:

1. They offer direct indexing at an incredibly competitive price, starting at 0.10% for the S&P 500.

2. The software is modern, clean and does everything I need it to do. I like the fact that I can make a recurring deposit, and customize my allocation percentages myself.

3. I'm a small investor in the company. Funnily enough, I invested in them when they were building an entirely different business... but hey, I love to support my portfolio!

Frec Signup Bonus for Silly Money Readers

We talked to the team at Frec and created a special signup bonus for anyone reading the Silly Money newsletter who wants to give the platform a shot.

Use this special link to create an account and you get a free $250 to try out their direct indexing product.

I’ve been personally using Frec for over a year, and have 7-figures invested there and keep moving over more new dollars to the platform.

Full Disclosure: We may receive compensation if you choose to open a Frec account with our link. As always, consider whether any financial product is appropriate for your specific situation.

What did you think of today's newsletter?

For the next week, I've been exploring the new Invest America accounts and I'll be sharing how they are lowkey an incredible tool for setting your children up with a massive retirement nest egg.

Until next time.

Disclosures: This post is for informational and educational purposes only and solely reflects the personal views of the author. It is not investment, legal, tax, or professional advice. Any examples, experiences, or investment returns discussed do not guarantee future results. Laws and regulations discussed are subject to change and may not apply to your individual circumstances. Unless specifically stated, posts do not reflect the views or opinions of The Vibes Company Inc. or its affiliates.