One of the highest-leverage tax moves you can still make before year-end has nothing to do with deductions, loopholes, or fancy structures. It’s getting a Solo 401k set up the right way before December 31 and claiming a little-known IRS tax credit worth up to $1,500. Most people don’t lose money on taxes because they don’t work hard enough. They lose money because no one ever sanity-checks their structure. And that’s why I want to flag this strategy today. If you have self-employment income (even from a side hustle), a Solo 401k can be one of the highest-impact tools in the tax code. It lets you:

- Lower your taxable income

- Decide between pre-tax vs post-tax treatment

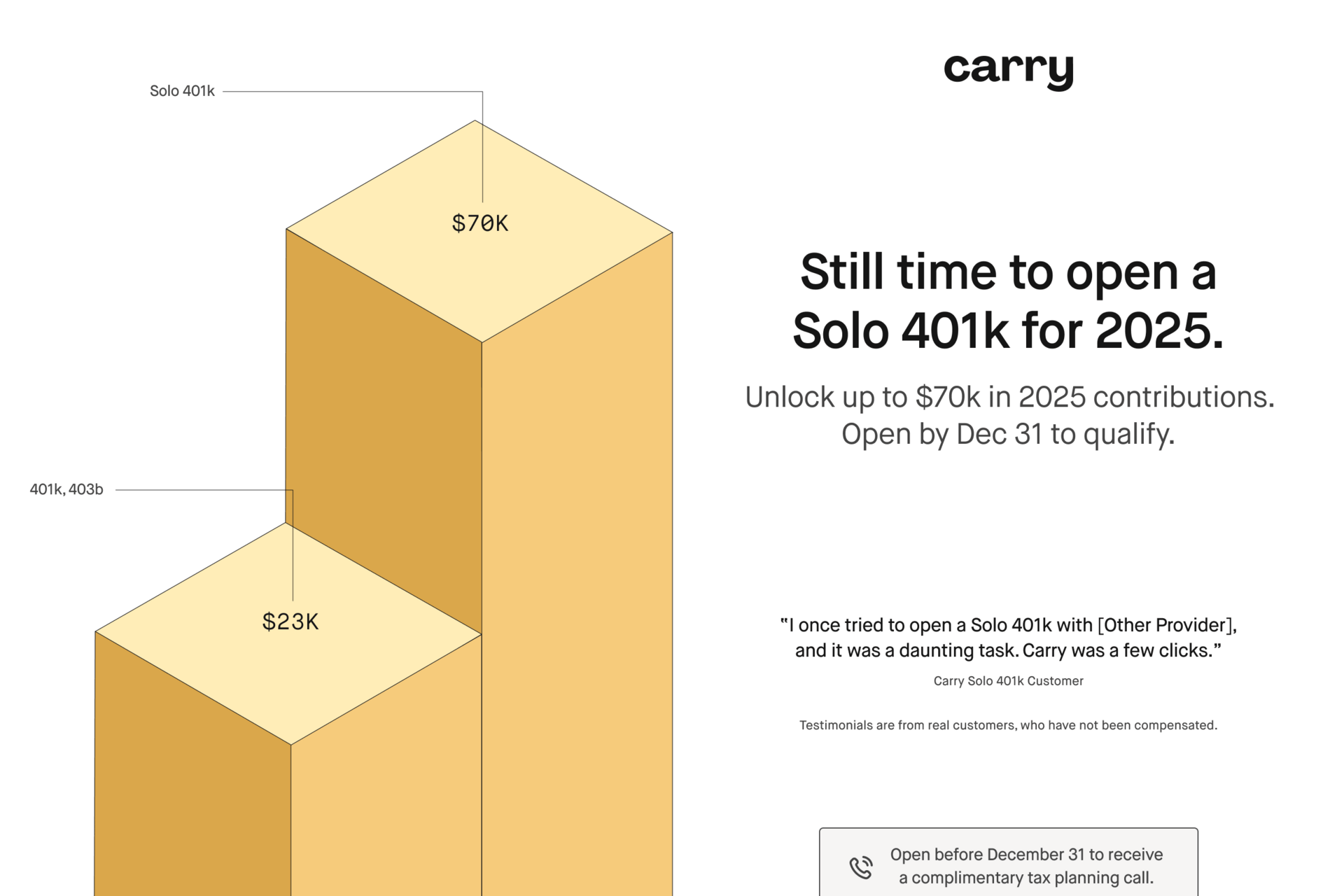

- Contribute far more than a traditional IRA (up to $70k per year!)

- And get $500 tax credit per year for up to 3 years simply for setting up your plan with the right provisions

But there’s a catch that most people miss. Unlike some of the other strategies we talk about here, this opportunity is tied to the calendar year. If you miss the year-end window, you’ll be left waiting another full year for the benefits.

Why this matters more than you may realize

Business owners have far more control over their tax bill than W-2 employees. The tax code is explicitly designed to reward:

- Self-employment

- Business ownership

- Retirement saving

Yet many people never take advantage of it. Not because they don’t qualify, but because they don’t act in time. A Solo 401k is one of the cleanest examples, and eligibility is broader than most people realize. You don’t need a formal business entity, and having a W-2 job doesn’t disqualify you. If you have any self-employment income (even a side hustle) and no full-time W-2 employees other than yourself, a partner, or a spouse, you can generally use a Solo 401k. And even if you also participate in a day job 401k, you can still contribute to a Solo 401k! If you’re eligible, a Solo 401k allows you to make both employee and employer contributions, which can add up quickly especially if you’re earning real money or combining a W-2 job with a side business. Depending on your income and plan design, that can mean contributing up to $70,000 per year ($77,500 if you’re 50+), far more than a traditional IRA or employee-only 401k. And unlike deductions that rely on spending more money, this is about redirecting money you’re already earning into a tax-advantaged structure. Another under appreciated feature: access to your capital. A properly structured Solo 401k with the right provider can allow penalty-free loans, generally up to 50% of your account balance (capped at $50,000). You’re borrowing from yourself, paying the interest back to your own account, without triggering taxes or early-withdrawal penalties if done correctly. For many business owners, that flexibility is the difference between feeling “locked up” and actually being comfortable putting more money away. And finally, investment flexibility. Unlike many employer plans with limited fund menus, a Solo 401k can allow you to invest in nearly anything, public stocks and ETFs, mutual funds, real estate, private investments, and more (subject to IRS rules). That means you’re not just saving on taxes. You’re deciding how and where your capital compounds.

How the tax credit works (and why most people miss it)

The IRS offers a little-known tax credit for small business owners who set up retirement plans with automatic contribution features. It’s called the Eligible Automatic Contribution Arrangement (EACA) credit, and it exists for a very specific reason. Lawmakers noticed a persistent problem in the retirement system: Even when people intend to save, they often don’t. So instead of trying to “educate” people into better behavior, the tax code took a different approach. The EACA credit rewards plans that make saving for retirement the default, not the exception. So if you structure your Solo 401k with automatic contribution turned on, the IRS offers a tax credit to offset the cost and friction of setting that plan up in the first place (thanks IRS!) And this is not a deduction. It’s a dollar-for-dollar reduction in your taxes. That distinction matters because a $500 deduction would only save you a fraction of that amount, depending on your marginal tax rate. The $500 per year credit reduces your taxes by $500 per year for three years. That’s $500 dollars you don’t have to pay the IRS and $500 more dollars for you to use however you see fit! The requirements to qualify for the EACA credit are pretty straightforward (but watch out because not all providers support it!):

- You need a Solo 401k plan set up before year-end

- The plan document must support automatic contributions

- You claim the credit using IRS Form 8881 when you file your tax return

Here’s the part most people don’t realize: You don’t actually have to contribute automatically every month to qualify. And eligibility is broader than people expect. You can qualify even if:

- You don’t have a formal business entity (a Schedule C is enough)

- You have a full-time W-2 job alongside your side income

- You already have an existing Solo 401k and restate it with the right provider

Unlike most high-impact tax strategies, the catch here isn’t complexity. It’s timing. If the plan isn’t established before December 31, the credit for that year is gone and it can’t be retroactively fixed.

Where most people get stuck

In theory, a Solo 401k sounds simple. Set up an account and start putting in dollars, right? In practice, people get tripped up on questions like: Am I actually eligible? Short answer: If you have any self-employment income (even a side hustle) and no W-2 employees other than yourself, a business partner, or your spouse, you’ll likely qualify for a Solo 401k. And it doesn’t matter if you have an LLC set up, you just need proof that you had income outside of a typical job! Should I go Roth or pre-tax this year? Short answer: It depends on whether you expect your tax rate to be higher now or in the future. Good news is you don’t have to lock this in at setup or before the December 31st deadline! So, you can talk with your accountant or tax advisor in the new year about contribution amount and type but you have to set up the account before the deadline. How does this interact with a W-2 401k? Short answer: You can have both! Your employee contribution limit is shared across plans ($23.5k for most people in 2025), but the employer side is separate, which means a Solo 401k can still unlock meaningful additional contributions. Can I still use it if I have an S-Corp or a Schedule C? Short answer: Yes, Solo 401k works for both LLC owners and sole proprietors. If you don’t have a business entity setup, you can still contribute your self-employment income! What do I need to do before Dec 31 vs after? Short answer: The plan must be established by December 31 to qualify for 2025 contributions and EACA credit (if you select it). Contributions and final allocations can be made later. So, if you have ever considered setting one up, now’s the time! If you want to go deeper on any of the above, I wrote this 3,000+ word guide on everything I know about Solo 401ks back in March. Regardless of your level of uncertainty, many people procrastinate. Or get stuck in the middle of the process because they get confused and start second guessing themselves. And then the year ends. And they are left without taking the most important step… Setting up the account so they can qualify for the current year! It’s the one thing people miss that can’t be reversed.

This is exactly why Carry was built. On paper, setting up a Solo 401k sounds simple. In reality, most people get stuck because the details matter, especially when credits like the EACA are involved. Carry helps business owners set up and manage Solo 401ks designed for real-world tax planning, not just basic compliance. It supports exactly what we’ve discussed in this edition:

- Solo 401k plans with EACA provisions

- Pre-tax and Roth Solo 401ks

- Coordination with income limits

- Advanced strategies like Mega Backdoor Roth

- Penalty-free loans so you can access your dollars without selling

- And a clean setup so you don’t have to piece everything together with multiple providers

This is important, because the EACA credit depends on plan design. If the plan document doesn’t support automatic contributions, the credit doesn’t apply even if everything else looks right. Carry handles this correctly from day one. All you have to do is select “automatic contribution” in your plan setup! As a Silly Money reader, you can use promo code SM2026 to get 50% off your first bill. That means new customers can get started with Carry for as little as $15! (Regular pricing is $29/month or $299/year and renews at that price after your first bill.) For business owners and freelancers, the $500 annual IRS credit alone can more than cover for the cost of membership. Everything else – the $70k contribution limits, tax deferral or Roth growth, investment flexibility, and access to strategies like Mega Backdoor Roth – is gravy on top. But this only works if the plan is set up before December 31. Once the year ends, the window to set up a plan (and claim this year’s credit) closes permanently. Set up your Solo 401k before the deadline »

Who should pay attention to this

This strategy is most relevant if you:

- Are self-employed, a founder, consultant, or freelancer

You earn income outside a traditional paycheck and want more control over how and when you pay taxes.

- Have a side hustle alongside a W-2 job

Even modest self-employment income can unlock planning opportunities that don’t exist inside a standard employer 401k.

- Expect to owe meaningful taxes this year

Especially if you’re in a higher tax bracket or had a strong income year and want to be proactive rather than reactive.

- Want to use retirement accounts strategically instead of reactively

This is about treating retirement plans as planning tools — not just long-term savings buckets. This strategy is not relevant if you only work a W-2 with no business or self-employment income. This strategy depends on having earned income outside of a traditional employer role.

Don’t miss the December 31st deadline

December 31 is the most important deadline for the EACA credit. Once the year ends:

- Contribution elections lock

- Planning windows close

- Missed opportunities can’t be retroactively fixed

If there’s one thing I’ve learned after years in the tax code, it’s this: The biggest wins come from acting before the deadline, not scrambling after it. If you think a Solo 401k might make sense for you, this is your moment. Get the EACA credit for 2025 before the deadline » And don’t forget to use code SM2026 to get 50% off your first bill with Carry!

Author Disclosure: I’m writing this as myself, not as some investment adviser or broker-dealer. I’m not a tax professional, this is all purely educational or my personal thoughts – not investment, legal, tax, or professional advice. Financial decisions involve risk, including losing money. Taxes are complex. Please do your own research or talk to a licensed pro before acting on anything you read here. Silly Money receives up to $10 USD from The Vibes Company for each new customer who signs up for a Carry membership using a Silly Money promo code. Silly Money is affiliated with Carry Advisors through common ownership under The Vibes Company, which creates a financial incentive for Silly Money to advertise Carry Advisors’ services. Carry Disclosures: For product-specific disclosures and third-party vendor information, please see Carry’s full disclosures here. Investment Options: While Carry Solo 401(k) and IRA plans may offer diverse investment options, including alternative assets, certain restrictions may apply. Some investments may be prohibited or result in penalties. Individual plan administrators, not Carry, are responsible for ongoing compliance of all plans with Carry.