Silly Money

The Tax-Efficient Guide to Charitable Giving

Giving season is here.

Fortunately for you, being charitable comes with phenomenal tax benefits.

It's the best of both worlds: you do social good, while also receiving very generous tax benefits if you play your cards right.

In this post, I report on the tricks used by the wealthiest Americans and their team of tax professionals to strategically use charitable contributions to reduce their taxes.

I’ll outline exactly how charitable giving benefits work — and my favorite strategies to maximize their impact.

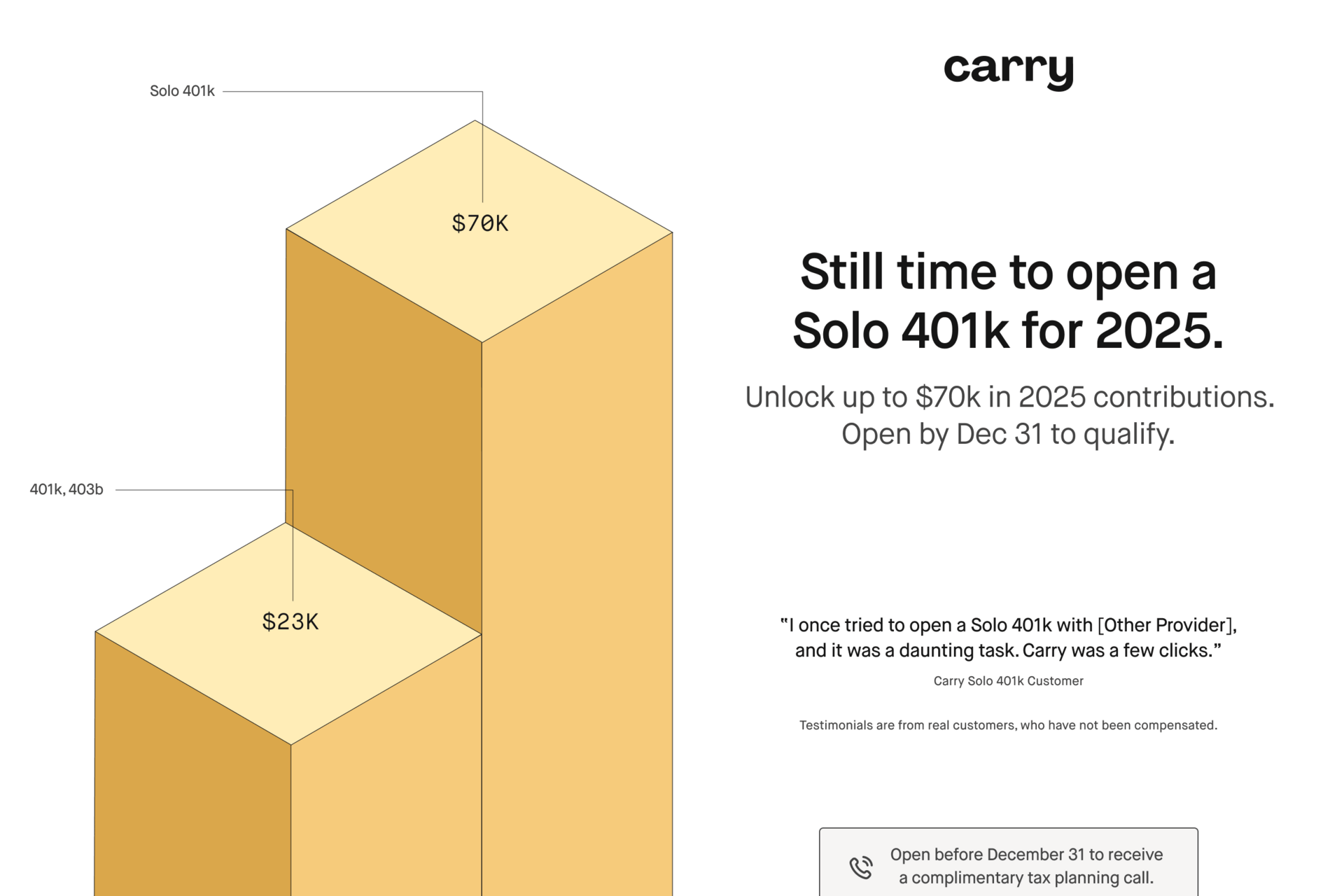

OK, a very important deadline is coming up.

If you have any self-employment income, you have until December 31 to open a Solo 401k.

The platform I use to run my Solo 401k is Carry (I’m also the founder) — there are a few reasons I chose Carry over everyone else:

I use the Mega Backdoor Roth loophole almost every year — Carry is the one of the only major Solo 401k platforms that support it.

My Solo 401k plan on Carry has automatic contributions enabled in the plan document. This makes me eligible for a $500 tax credit for 3 years… this more than covers the cost of my own subscription!

Carry supports alternative investments from either my Solo 401k or IRA — I’ve been investing in crypto and startups from my Roth IRA to try and compound a large retirement nest egg.

I use the Carry platform for other tax tricks like the Backdoor Roth IRA, taxable Roth conversions and better yields on my uninvested cash.

Beyond that, the Carry platform has a very modern interface, super quick and painless plan setup and a team that is constantly working hard to ship new features.

As a Silly Money reader, you can use coupon code SM2026 for 50% off your first year of a Carry membership.

This offer expires on December 31, so act now! Sign up here.

Charitable Giving and Taxes

Donating to charity typically gives you a dollar for dollar deduction on your taxes.

Consider an example: if you have $500K of income and you donate $50K to charity, your taxable income is reduced to $450K.

There are two important caveats:

1) You need to itemize your deductions versus taking the standard deduction for charitable contributions to be fully deductible.

2) There is a cap on how much you can deduct as it relates to your taxable income.

If you are donating cash, your maximum charitable contribution is capped at 60% of your adjusted gross income (AGI).

If you are donating appreciated assets, your maximum charitable contribution is capped at 30% of your AGI.

If you end up going over, you can typically "carry over" the deduction for up to 5 years.

Donating to private foundations gets trickier since these are subject to lower caps of 30% cash and 20% in appreciated assets.

Charitable Donation Recipients

Something that initially surprised me about the American tax code is the diversity of institutions that can get you a charitable deduction under the right scenarios.

It’s not just contributions to organizations we traditionally think of as charities that count!

Most contributions go to a “qualified organization” which are typically 501c(3) organizations, that includes organizations operated exclusively for:

Religious purposes (e.g., churches, synagogues, mosques)

Charitable purposes (e.g., relief of the poor, advancement of education or science)

Educational purposes (e.g., schools, universities, museums)

Scientific purposes (e.g., medical research organizations)

Literary purposes

Testing for public safety

Fostering national or international amateur sports competition

Prevention of cruelty to children or animals (e.g., humane societies)

Additionally, you can contribute to either public charities or private foundations. And then, there are structures in between like charitable trusts and donor-advised funds that we’ll talk about later.

It’s easy to think of charitable contributions applying only to charitable causes, but there are lot of other causes that can get you a meaningful tax deduction!

Changes in 2026

Starting in 2026, the charitable contribution deduction gets slightly less generous for the wealthiest taxpayers, while offering a bit more to everyone else.

There are three important changes to be aware of:

1) Small charitable deductions available even to people who take the standard deduction

You can get a small above-the-line deduction (this reduces your AGI) of up to $1,000 (single) or $2,000 (married) for donations to public charities.

Donor-advised funds and private foundations would not count.

2) 0.5% Adjusted Gross Income (AGI) floor for itemized deductions

Itemized deductions will be subject to a 0.5% floor starting in 2026.

In the example above: with $500,000 income and a $50,000 donation, the first 0.5% or $2,500 will NOT be deductible for taxes.

Your charitable deduction will only be $47,500.

3) Deduction benefit capped at the 35% federal tax bracket

Even if you pay taxes at the highest federal rate (37% right now), your charitable deduction benefit will be capped at a 35% tax rate.

In practice, this means your charitable deduction amount is reduced by the difference between the two tax rates if you are at the highest tax bracket, making the tax saving impact smaller in 2026.

Putting it All Together

Let's consider the example of someone with an AGI of $1M making a $100K contribution.

In 2025, you would get a $100,000 deduction and a $37,000 tax savings (at the 37% tax bracket).

In 2026, there is now a cap and a floor. With the 0.5% AGI floor, the first $5,000 is not deductible at all.

Tax savings on the leftover amount is capped at 35% leading to tax savings of $95,000 * 35% = $33,250

The exact same charitable donation in 2026 will save you $3,750 less in taxes.

If you are debating between a large charitable deduction in 2025 and 2026, you’ll save more on your taxes this year.

Donating Appreciated Assets

Wherever possible, consider donating long-term appreciated assets instead of cash.

You unlock two tax benefits:

1) You avoid capital gains taxes on the sale

2) You can deduct the full fair-market value of the asset… not just what you bought it for.

Everyone wins — you get a bigger tax deduction and the charity gets more money.

But, there are two important restrictions to be aware of:

1) You can only deduct the appreciation on long-term appreciated assets that you have held for 1-year or more. Short-term assets are limited to what you paid in costs!

2) This deduction is capped at 30% of your AGI for a given year. If you go over, you can carry forward the deduction for up to 5 years.

Types of Assets You Can Donate

You can donate all kinds of appreciated assets to charity and capture a big tax deduction. The most common types are:

Public Company Stock

This is the most common appreciated asset that is donated to charity since it’s extremely straightforward to calculate the fair-market value.

A strategy I like to use while donating stock:

Sort your brokerage by securities that have appreciated the most. Drill down into the specific tax lot that has the lowest cost basis (aka would have the highest tax bill).

Donate it to a charity or donor-advised fund and capture a tax deduction for the full value.

You can immediately re-buy the exact same shares at the current price. This resets your cost basis much higher (thereby reducing future taxes!)

Unlike tax loss harvesting, there is no mandatory 30-day waiting period before buying back the exact same security.

Cryptocurrency

Donating crypto works very similarly to public stock. Lots of modern charities and donor-advised funds now accept contributions in crypto.

As long as you have held it for more than 365 days, you can deduct the fair market value on donation.

Private Company Stock

Donating shares in private companies strategically can save you a meaningful amount of money, particularly if you are the founder and own a large amount of equity.

However, this is substantially trickier to execute and typically requires professional help making it only worth it for very large donations.

A few different things you’ll need to execute this:

A charity or donor-advised fund that is able and willing to accept the donation.

A third-party qualified appraisal of the value of the shares — no earlier than 60 days before the donation, and no later than your tax filing date.

A tax professional used to these types of transactions. You need to file the right paperwork with your taxes.

Art

Donations are not just limited to financial assets!

You can donate art to charity — and as long as the charity uses the art in a way that is related to its exempt purpose, you can capture a deduction at the full fair-market value.

This means if you donate art to a museum, you can get a deduction for the full current value of the art.

If you donate art to another type of charity, you are limited by what your cost was.

Again, you need a qualified third party appraisal here as well.

For the right art investor with a discerning eye for spotting undervalued artwork, this can save a massive amount in taxes.

Donor-Advised Funds

A donor-advised fund (DAF) may be my favorite charitable giving tool.

A DAF allows you to make an upfront contribution of either cash or other appreciated assets, and receive a full deduction for the amount donated.

Once the assets are inside the fund, you can then donate to charity on your own timeline… even many years later!

A DAF is especially useful in a couple of scenarios:

You are facing a very large tax bill, and want to capture a large charitable deduction to offset it but aren’t sure exactly which charities to donate the funds to.

You are itemizing your deductions for a specific year, and want to capture the maximum benefit and front-load the charitable contributions you would otherwise make for several years.

The assets inside the donor-advised fund are also typically invested so they are constantly growing, leading to more money for charity down the line.

Bunching Deductions

A donor-advised fund is a very valuable tool in “bunching deductions”.

Charitable contributions are one of the many tax deductions that are only available if you itemize your deductions.

If you are itemizing in a specific year, but typically take the standard deduction, it could be worth “bunching deductions” and trying to sneak in a few other itemized deductions for that specific calendar year.

Some tools for squeezing in extra itemized deductions include:

A donor-advised fund since this allows you to contribute a larger amount upfront, and then give to charity on your own timeline.

Prepaying property or local taxes. Some jurisdictions let you pay in December for the upcoming quarter of year.

Making an extra mortgage payment. If you have mortgage interest that’s tax-deductible with itemized deductions, an extra mortgage payment in a year you itemize is more valuable.

If you have very large, elective medical expenses that exceed 7.5% of your AGI, scheduling them in the year that you are electing to itemize your deductions.

Qualified Charitable Distributions (QCDs)

For taxpayers over the age of 70.5, qualified charitable distributions or QCDs can be substantially more advantageous than regular charitable contributions.

A QCD allows retirees to contribute up to $108,000 (in 2025) to a qualified public charity from their Traditional IRA.

A QCD has a few separate tax benefits:

1. Charitable deduction without needing to itemize, lowering AGI

Taxpayers can deduct a QCD “above-the-line” to reduce their adjusted gross income directly.

This allows people to take a tax deduction from a charitable contribution without needing to itemize i.e. you can take both the standard deduction and get a dollar-for-dollar tax deduction for gifting to charity.

A QCD also reduces the taxpayers AGI. This helps in a bunch of other ways like keeping you in a lower tax bracket, reducing taxation on Social Security benefits, Medicare premiums and more.

2. Bypasses the 2026 restrictions on charitable gifts

QCDs bypass the new two 2026 changes that make charitable contributions less tax-advantageous: the 0.5% AGI floor and the benefit cap for 37% taxpayers.

3. Satisfies taking RMDs tax-free

If you are subject to required minimum distributions (RMDs), a QCD fulfills the distribution requirement without triggering any taxes.

If you otherwise take the distribution and then donate to charity, you would still be on the hook for the taxes due.

Advanced Strategies

Despite this rather comprehensive post, I’m barely scratching the surface on some of the more advanced strategies that I will save for a later time.

I’ll quickly list and summarize some of them here so you know what to look for in the future:

Private Foundation

For super high net-worth taxpayers, a foundation is substantially more powerful than a donor-advised fund. But, a foundation is a lot, lot more painful to administer.

With a foundation, you have complete control over every aspect — you can hire family members and pay them salaries, you can fund scholarships, you have full autonomy over grants and operations.

However, they take a lot of work to run!

You also have to donate at least 5% of the assets every single year and your maximum deduction is capped at a lower percentage.

Conservation Easements

This is a highly controversial strategy of donating land use restrictions (i.e. agreeing to not develop certain land you may own) to a qualified organization in return for a large write-off.

Charitable Remainder Trusts (CRT) / Charitable Lead Trusts (CLT)

CRTs are irrevocable trusts that pay you an income stream for a specific period of time, while donating the rest to charity.

CLTs are the opposite structure - they pay an income stream to charity, while leaving the rest to you.

Donating a life insurance policy to charity

This sounds crazy, but you can donate your life insurance value to charity (i.e. charity gets paid when you die) and receive a tax deduction for the cash value of the policy at the time.

What did you think of today’s issue? Reply to this email, I’d love to know.

I personally read every single response!

The big theme here (and across my writing) is that it’s important to be intentional about where your money goes before year-end.

Carry is one of the software platforms that brings together a lot of the Silly Money tax saving strategies, like:

The Solo 401k plan that has all the “features” including alternative investments, participant loans, automatic contributions (& the related tax credit) and more.

Support for all kinds of advanced Roth strategies like a Backdoor Roth IRA, Mega Backdoor Roth IRA and taxable Roth conversions.

Smarter cash management on uninvested cash that aims to pay you the most net of taxes.

Tax filing support available (for an additional fee) to ensure nothing is lost between execution and filing.

December 31 is the deadline for lots of people with self-employment income to set up a Solo 401k, so this offer is very timely.

Get started at carry.com & use promo code SM2026 to receive 50% off your first year bill.

Author Disclosure: I'm writing this as myself, not as some investment adviser or broker-dealer. I’m not a tax professional, this is all purely educational or my personal thoughts - not investment, legal, tax, or professional advice. Financial decisions involve risk, including losing money. Taxes are complex. Please do your own research or talk to a licensed pro before acting on anything you read here.

Silly Money receives up to $10 USD from The Vibes Company for each new customer who signs up for a Carry membership using a Silly Money promo code. Silly Money is affiliated with Carry Advisors through common ownership under The Vibes Company, which creates a financial incentive for Silly Money to advertise Carry Advisors’ services.

Carry Disclosures: For product-specific disclosures and third-party vendor information, please see Carry’s full disclosures here.

Investment Options: While Carry Solo 401(k) and IRA plans may offer diverse investment options, including alternative assets, certain restrictions may apply. Some investments may be prohibited or result in penalties. Individual plan administrators, not Carry, are responsible for ongoing compliance of all plans with Carry.